Before purchasing a vehicle, it’s crucial to do research on the dealership to avoid doing business with a sketchy seller. However, even if the dealership appears to be reputable, there is still a chance that they may deal in some dishonest practices. Because purchasing a vehicle is such a large investment, it’s a good idea to familiarize yourself with some of the most common scams that deceitful auto dealerships may use to try and swindle you. Doing so will help you know what to look out for and how to avoid falling victim to deceptive business practices. Without further ado, here are some of the most common auto dealership scams to look out for.

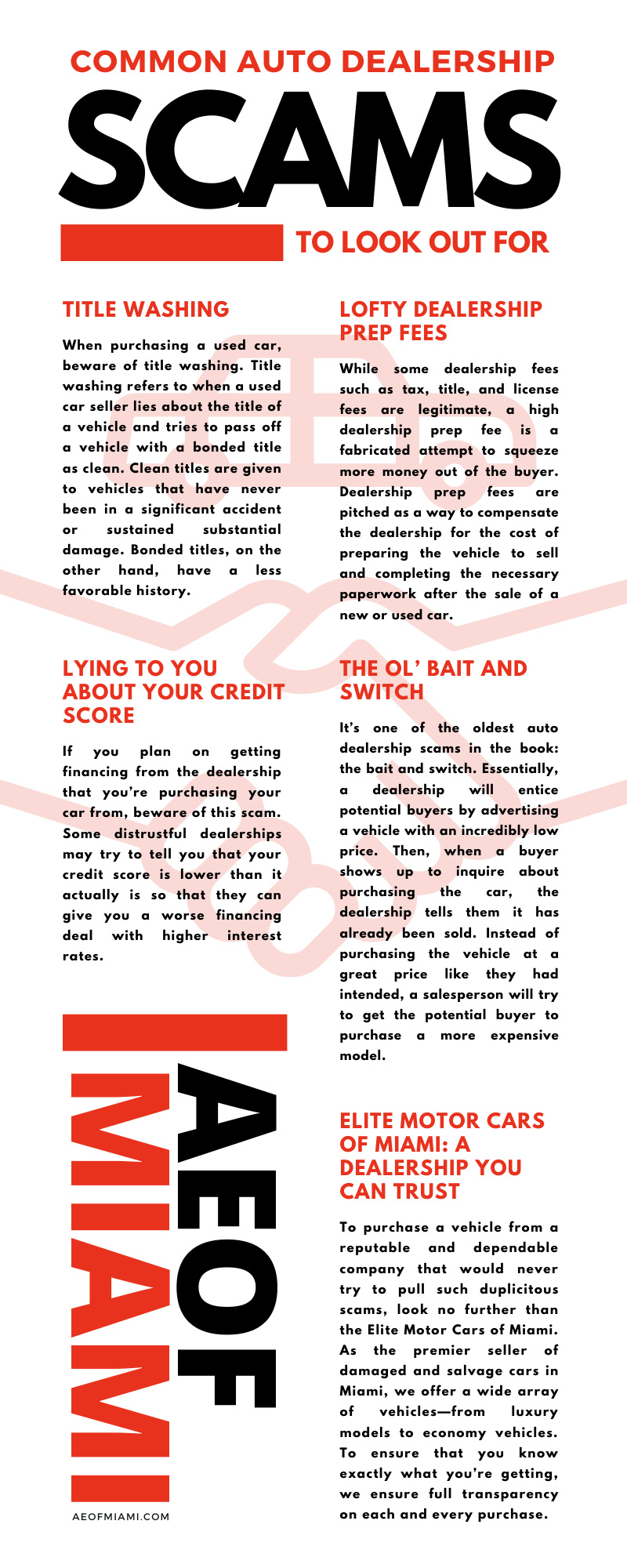

When purchasing a used car, beware of title washing. Title washing refers to when a used car seller lies about the title of a vehicle and tries to pass off a vehicle with a bonded title as clean. Clean titles are given to vehicles that have never been in a significant accident or sustained substantial damage. Bonded titles, on the other hand, have a less favorable history and may have been salvaged, in a flood, had their odometer rolled back, or any number of other issues. Because used vehicles with a clean title are often viewed as a less risky purchase, sellers may try to pass a vehicle with a bonded title off as a clean title in order to sell it for more money.

Doing so is illegal and involves bringing a bonded vehicle to a different state where the brand isn’t recognized and re-registering it as clean. Falling for this scam won’t just cause you to pay more for a vehicle—it could also put your safety at risk since you won’t be aware of any serious issues that the vehicle has. To avoid purchasing a vehicle that had its title washed, make sure to get a vehicle history report to make sure that the seller's name and information match the information on the vehicle’s title document. In addition, it is also a good idea to get a thorough pre-purchase inspection by a third-party mechanic to spot any potential issues or red flags.

If you plan on getting financing from the dealership that you’re purchasing your car from, beware of this scam. Some distrustful dealerships may try to tell you that your credit score is lower than it actually is so that they can give you a worse financing deal with higher interest rates. Fortunately, falling for this sneaky practice is easily avoidable.

To prevent dealerships from tricking you into thinking you have a bad credit score, all you need to do is get a copy of your credit report that includes your credit score. Then, if the dealership tries to convince you to choose their high-interest financing option due to your bad credit, you can simply show them your report. After they’ve tried to pull such a scam on you, you’ll probably want to shop around for financing from a more honest institution.

Another one of the most common auto dealership scams to look out for is lofty dealership prep fees. While some dealership fees such as tax, title, and license fees are legitimate, a high dealership prep fee is a fabricated attempt to squeeze more money out of the buyer.

Dealership prep fees are pitched as a way to compensate the dealership for the cost of preparing the vehicle to sell and completing the necessary paperwork after the sale of a new or used car. Generally, this fee is not brought to the buyer’s attention until right before they are asked to sign the paperwork for their vehicle and can often range from as much as $100 to $600.

Because vehicle preparation is simply a part of doing business, it is inappropriate for dealerships to try and make an extra profit by asking buyers to pay exorbitant dealership prep fees. To avoid getting duped, ask the seller to drop this fee before sealing the deal. Because dealership prep fees are almost always negotiable, you should be able to significantly reduce or eliminate it entirely.

It’s one of the oldest auto dealership scams in the book: the bait and switch. Essentially, a dealership will entice potential buyers by advertising a vehicle with an incredibly low price. Then, when a buyer shows up to inquire about purchasing the car, the dealership tells them it has already been sold.

Instead of purchasing the vehicle at a great price like they had intended, a salesperson will try to get the potential buyer to purchase a more expensive model. The idea behind this tactic is that people will be more likely to purchase a car if the dealership can just get them in the showroom where they can more easily convince them into the sale.

To avoid getting pressured into purchasing a car that is more expensive than you would like, call the dealership ahead of time to confirm that the vehicle you’re interested in buying is still in stock. Then, request a signed statement via email that confirms that the vehicle is still available for sale. Unless the vehicle gets sold in the short amount of time it takes you to get to the dealership, you can reduce your chance of getting drawn into a situation with false promises.

By being aware of these common auto dealership scams that untrustworthy sellers can try to pull, you can reduce your chances of getting a bad deal. To purchase a vehicle from a reputable and dependable company that would never try to pull such duplicitous scams, look no further than the AE of Miami.

As the premier seller of damaged and salvage cars in Miami, we offer a wide array of vehicles—from luxury models to economy vehicles. To ensure that you know exactly what you’re getting, we ensure full transparency on each and every purchase. As such, each of our listings includes a clear description of the damage type and condition of the vehicle. To learn more about our inventory and find a vehicle that is right for you, contact us today.